Chinese EVs Surge: New Models, L3/L4 Tech, 47% First-Time Buyers

China's EV sector explodes with Hongmeng Zhixing's multi-brand new cars like Zhijie V9 MPV and L3/L4 autonomy from 2025, Ideal's L4 'space robot' in three years, and Xiaomi's family SUV/GT/luxury trio. A Bloomberg survey shows 47% of first-time buyers favoring pure EVs, boosted by 5-min fast charging for 400-520km range. These moves deepen ecosystem ties and challenge global rivals amid Nvidia H200 approvals.

In a whirlwind week for China's electric vehicle (EV) industry, Harmony Intelligent Mobility (Hongmeng Zhixing) unveiled multiple upcoming models from its 'five realms' brands—Ask界 (Wenjie), 智界 (Zhijie), 享界 (Xiangjie), 尊界 (Zunjie), and 尚界 (Shangjie)—while announcing deeper ecosystem collaboration. Ideal Auto eyes L4 autonomous driving within three years, Xiaomi teases three new vehicles, and a Bloomberg survey reveals 47% of first-time Chinese car buyers now prefer pure EVs, up from 25% earlier this year. These developments, reported on December 9 across D1EV and other sources, signal China's EV market accelerating toward software-defined vehicles and mass adoption amid global tech tensions.

Hongmeng Zhixing's Ambitious Lineup and L3/L4 Push

Harmony Intelligent Mobility, powered by Huawei technologies, dominated headlines with fresh reveals from executive Yu Chengdong during its annual livestream. Key announcements include:

- 尚界 (Shangjie): Two new cars, including a premium coupe set for spring 2025 release.

- 智界V9: First MPV flagship with Huawei's DriveONE 800V silicon carbide powertrain, 192-line LiDAR, and Whale battery; launches next year.

- 奇瑞 9-series MPV and sports SUV: Additional MPV plus a high-performance SUV eyeing fall/winter 2025 debut.

- 享界 and 尊界: Innovative 'boxy' design for Xiangjie and completed ultra-luxury Zunjie model for 2025 unveiling.

Yu Chengdong boldly predicted a shift to L3 and L3+ autonomous driving starting 2025—allowing hands-off-the-wheel naps—aiming for L4 by 2027. The 'five realms' also deepened strategic ties in Shanghai, focusing on unified standards for HarmonyOS cockpits, shared service networks, joint charging stations, R&D centers, and integrated marketing.

Ideal Auto's Vision for L4 'Space Robots'

Ideal Auto's leadership envisions cars evolving into AI-driven 'space robots' over the next 5-10 years, prioritizing software, AI models, computing power, OS, and hardware. Milestones include:

- First L4 model (no steering wheel/pedals) within three years.

- L3 as a bridge to full autonomy, tackling perception, decision-making, redundancy, and cybersecurity via VLA driver models and 'world models'.

- Open-sourcing 'Ideal Star Ring OS' for ecosystem innovation; CEO Li Xiang to oversee HR in a matrix structure for AI agility.

This aligns with industry trends where Chinese OEMs like BYD and NIO lead in scaling data-closed loops, closing the gap with global leaders despite compute infrastructure lags.

Xiaomi's Expansion Amid Organizational Shifts

Xiaomi Auto faces China market pressures with order slowdowns and dealer inventory issues, prompting executive reshuffles including sales ops under President Wang Xiaoyan. To counter, three new models were leaked:

| Model | Positioning | Key Specs | Timeline |

|---|---|---|---|

| YU9 ('Kunlun') | Family large SUV | >5.2m length, 6/7 seats, range-extender | Soon |

| YU7 GT | High-performance SUV | Nürburgring-tested, rivals Tesla Model Y Performance | Europe focus |

| SU7 L | Luxury extended sedan | >5.2m length, >3.1m wheelbase, rear luxury | Business market |

These bolster Xiaomi's play in family, performance, and executive segments.

Market Boom: 47% First-Time Buyers Choose Pure EVs

Bloomberg Intelligence's November survey of 1,000 prospective buyers shows pure EV preference hitting 47% among first-timers (from 25% in February), and 52% overall for next purchases. Drivers include price parity with ICE, tech appeal, and fast-charging advances:

- BYD: 5-min charge for 400km range.

- CATL Shenxing: 5-min for 520km.

NEV sales penetration nears 50% in 2024, with China targeting 28 million chargers by 2027 (50% growth). Subsidies fading pushes infra investment, narrowing urban-rural gaps.

Tech Ecosystem and Global Ripples

Supporting news: Huawei's 2012 Lab launches foundational AI models dept.; Geely finalizes Zeekr privatization with $7.01B cash/equity deal; Nvidia approved for H200 AI chip exports to China (25% US govt cut). Volvo seeks partners for its SPA3 platform and software stack (ex-China due to geopolitics), highlighting collaboration trends post-EX90 woes.

Why This Matters: Global Implications

China's EV surge—fueled by 800V platforms, LiDAR autonomy, and AI integration—intensifies competition for Tesla, Rivian, and legacy automakers. With 47% first-time buyer shift and L4 ambitions, Beijing's ecosystem (Huawei, Xiaomi, Ideal) could export 'space robots' globally, challenging US/EU dominance. Nvidia's H200 nod eases AI compute access but preserves a tech generation lead, while Volvo-Geely tensions underscore data security risks.

Looking Ahead

2025 brings L3/L4 debuts, Xiaomi's trio, and Zhijie V9, potentially propelling NEV share past 60%. Watch for Ideal's L4 prototype and charging infra ramps amid subsidy exits. China's EV playbook—affordable tech, alliances, rapid iteration—sets the global pace.

Original Sources

Related Articles

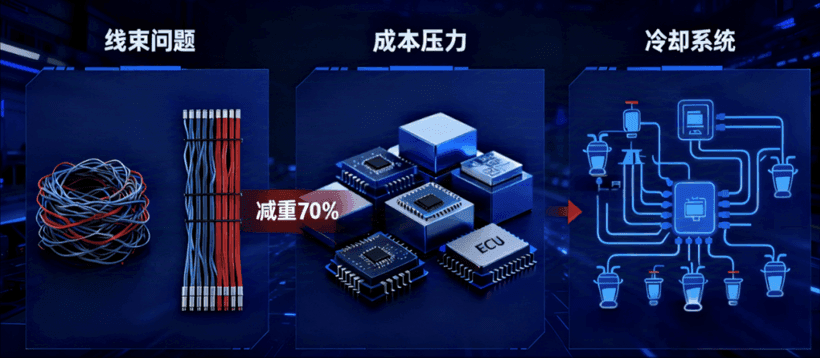

China EV News: XCU Hits 500K, L3 Approval, Power Deals

China's EV sector surges with Jingwei Hengrun's XCU hitting 500K units on Geely Xingyuan, MIIT approving two L3 autonomous models from Changan and BAIC BluePark, and Dongan Power's strategic lab with BAIC Manufacturing for off-road NEVs. These breakthroughs tackle wiring costs, boost autonomy, and enhance powertrains amid 2024's 9.5M NEV output. They solidify China's lead in software-defined vehicles and global EV competition.

Chinese EVs Dominate: Record Sales, AI Advances & Factory Milestones

Global EV sales smashed records at 2 million units in November 2025, with China's 1.32 million dominating amid BYD export highs and Tesla Shanghai's 400 millionth car. Funding surges for Deepal (6.12B RMB) and JAC (3.5B RMB) fuel smart platforms, while AI advances like DeepMind's 2028 AGI odds and具身智能 breakthroughs promise L4 'space robots.' EU price talks ease tariff fears, positioning Chinese EVs for global leadership.