Li Auto's L4 Push & China's ADAS Surge in 2025

Li Auto plans a steering-wheel-free L4 EV in three years, fueled by massive AI investments amid China's 2025 ADAS boom where domestics dominate air suspension (88%+ share) and LiDAR (94% top 3). A new dry-process battery electrode tech promises greener production. This surge highlights China's EV innovation edge, reshaping global autonomous driving.

Li Auto is gearing up for a revolutionary shift in the Chinese EV market, planning to launch its first Level 4 (L4) autonomous driving model within three years—complete with no steering wheel or pedals, transforming cars into mobile living or workspaces. This bold move, dubbed the industry's 'iPhone 4 moment,' coincides with explosive growth in China's ADAS sector through October 2025, where domestic suppliers are dominating key areas like air suspension and LiDAR amid a surge in smart EV adoption. Meanwhile, breakthroughs in dry-process battery electrodes promise greener manufacturing, underscoring China's multifaceted EV innovation drive.

Li Auto's Ambitious L4 Autonomous Vision

Ideal (Li Auto), a frontrunner in China's premium EV space, is investing heavily—over 6 billion RMB annually—in its VLA (Vision-Language-Action) driver model to enable true hands-free driving. The company aims for a steering-wheel-free L4 vehicle by 2028, with Chairman Li Xiang eyeing a 50% chance of an AI supercar by 2030.

Key challenges include:

- Technical hurdles: Achieving reliability in perception, decision-making, control, redundancy, and cybersecurity; requires 5 million+ vehicle data scale.

- Market and regulatory: Public acceptance, laws, and liability in accidents.

- Tech gaps: Li Auto admits a 'generational difference' in compute infrastructure and data loops versus global leaders.

To bridge this, Li Auto is developing a universal 'world model' for better generalization and open-sourcing its 'Li Xinghuan OS' for ecosystem collaboration. The vision? Cars evolving from transport tools to AI-powered 'space robots' with natural language commands (e.g., 'park here') and 'super alignment' for safer, comfier rides.

Battery Tech Breakthrough: Dry-Process Electrodes

A Korea-led team (KIER, Cambridge, Ulsan) has pioneered a dry manufacturing method for secondary battery electrodes, published in Energy & Environmental Science. This solvent-free process creates dual-fiber structures ('thread-like' and 'rope-like') to boost strength and performance, sidestepping wet-process pollution and costs.

- Wet vs. Dry: Wet uses solvents (dominant but eco-burdened); dry is faster, greener but limited by binders like PTFE.

- Advantages: Reduces energy use, pollution; enables scalable EV batteries.

This aligns with China's EV supply chain push, potentially accelerating mass production of high-density cells for models like Li Auto's future L4 EVs.

2025 ADAS Market Boom: Domestic Dominance

From January to October 2025, China's passenger car ADAS market showcased native suppliers' breakout, with headroom solidifying in air suspension, LiDAR, parking, and more. Domestic firms leveraged tech leaps, cost control, and local integration for market share gains.

Key Supplier Rankings (Jan-Oct 2025)

| Category | Top Supplier | Installs | Share | Notes |

|---|---|---|---|---|

| Air Suspension | Top Group | 339,343 | 36.4% | Domestic top 3 >88% share |

| Konghui Tech | 290,541 | 31.2% | ||

| Baolong Tech | 195,633 | 21.0% | ||

| LiDAR | Huawei | 962,210 | 41.8% | Top 3 >94% share |

| Hesai Tech | 784,789 | 34.1% | ||

| Robosense | 421,928 | 18.3% | ||

| Driving ADAS | Bosch | 1,988,915 | 15.9% | BYD #2 at 13.3% (self-dev) |

| BYD | 1,664,952 | 13.3% | Multi-player battle | |

| Front Camera | Bosch | 1,752,704 | 14.0% | Chinese firms rising fast |

| Sunny Optical | 1,138,913 | 9.1% | ||

| Auto Parking | BYD | 1,507,778 | 21.7% | OEM self-research leads |

| Bosch | 889,562 | 12.8% | Li Auto in mix |

Li Auto and BYD exemplify OEM self-reliance, while Huawei and Hesai crush LiDAR.

Why This Matters: Global Implications

China's EV ecosystem is redefining mobility: Li Auto's L4 bet signals a shift to AI-driven 'production tools,' backed by ADAS localization (e.g., 88%+ domestic air suspension). Battery innovations cut costs/env burdens, fueling exports amid Tesla/BYD rivalry. Globally, this pressures Western firms—expect U.S./EU tariffs but inevitable tech diffusion, accelerating autonomous EV adoption worldwide.

Looking Ahead

By 2030, expect Li Auto's L4 rollout to catalyze 'no-wheel' norms if regs align, with ADAS penetration hitting 50%+ in China. Domestic suppliers' edge could make Chinese EVs unbeatable on price/tech, but closing the 'generational gap' in AI compute remains key. Watch for VLA model demos and dry-battery scaling—these threads weave China's path to EV supremacy.

Original Sources

Related Articles

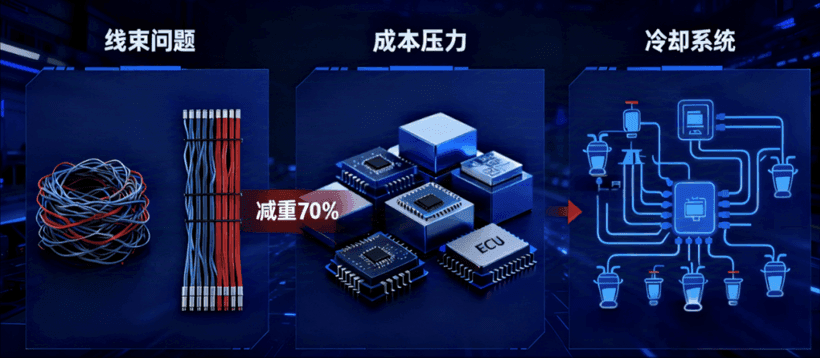

China EV News: XCU Hits 500K, L3 Approval, Power Deals

China's EV sector surges with Jingwei Hengrun's XCU hitting 500K units on Geely Xingyuan, MIIT approving two L3 autonomous models from Changan and BAIC BluePark, and Dongan Power's strategic lab with BAIC Manufacturing for off-road NEVs. These breakthroughs tackle wiring costs, boost autonomy, and enhance powertrains amid 2024's 9.5M NEV output. They solidify China's lead in software-defined vehicles and global EV competition.

Chinese EVs Dominate: Record Sales, AI Advances & Factory Milestones

Global EV sales smashed records at 2 million units in November 2025, with China's 1.32 million dominating amid BYD export highs and Tesla Shanghai's 400 millionth car. Funding surges for Deepal (6.12B RMB) and JAC (3.5B RMB) fuel smart platforms, while AI advances like DeepMind's 2028 AGI odds and具身智能 breakthroughs promise L4 'space robots.' EU price talks ease tariff fears, positioning Chinese EVs for global leadership.