NIO Slams EREV Waste as BYD Dominates China EV Market

NIO Onvo's CEO blasts large EREV batteries as wasteful, touting profitable battery swaps amid 8,000-pack expansion. BYD leads China's NEV market with 23.2% November share, as Huawei's Luxeed V9 MPV promises L3 autonomy in 2026. These shifts signal declining range anxiety and smarter EV strategies in the world's top market.

In a bold critique shaking up China's electric vehicle (EV) landscape, NIO's Onvo CEO Shen Fei declared large extended-range EV (EREV) batteries wasteful amid maturing charging networks. This comes as BYD solidified its market lead with 23.2% share in November 2025 retail sales, while Huawei-backed Luxeed gears up for its V9 MPV flagship in Spring 2026. These developments highlight shifting strategies in the world's largest NEV market, blending battery swap innovations, market dominance, and upcoming tech showcases.

NIO Onvo CEO Challenges EREV Trend: Batteries as Waste?

NIO's Senior VP and Onvo CEO Shen Fei, in an interview with The Paper, argued that oversized batteries in EREVs squander resources. With charging infrastructure advancing rapidly, these systems eat cabin space and add 15,000 yuan ($2,100 USD) for the range extender—burdens for makers and buyers alike.

Key revelations include:

- Battery Swap Expansion: Onvo plans to double capacity with 8,000+ new packs by mid-January 2026, boosting from ~7,000 packs at 2,300 stations.

- Profit Model: Leveraging peak-valley electricity arbitrage, each 50 kWh battery earns 12,000-20,000 yuan ($1,680-$2,800 USD) annually—highly lucrative over its lifecycle.

- Consumer Shift: 40% of Onvo L90 owners (standard 85 kWh) opt for 60 kWh via Battery-as-a-Service (BaaS), saving 3,600 yuan ($504 USD) yearly, signaling fading range anxiety.

Shen called EREV battery bloat "incremental innovation," praising battery swapping as systemic progress. With 120,000 Onvo vehicles and a 60:1 vehicle-to-station ratio, NIO targets 4-7 packs per station for optimal service.

China NEV Market Snapshot: BYD's Iron Grip, Tesla Rebounds

BYD reigned supreme in November 2025 passenger NEV retail sales per China Passenger Car Association (CPCA), underscoring its hybrid and BEV prowess.

| Rank | Automaker | Nov Sales (Units) | Market Share | YoY Change |

|---|---|---|---|---|

| 1 | BYD | 306,561 | 23.2% | -26.5% |

| 2 | Geely Auto | 172,169 | 13.0% | +42.4% |

| 3 | SAIC-GM-Wuling | 96,194 | 7.3% | N/A |

| 5 | Tesla | 73,145 | 5.5% | -5% |

| 10 | Xiaomi EV | 46,249 | 3.5% | N/A |

BYD's share ticked up from October's 23.1%, with Jan-Nov dominance at 27.4% (3.14M units). Tesla climbed to 5th (from outside top 10) via 73k sales, while Geely surged 42% YoY. Year-to-date, Tesla holds 4.6%.

Luxeed V9 MPV: Huawei's Tech Flagship on Horizon

Transitioning to premium segments, Huawei's Harmony Intelligent Mobility Alliance (HIMA) named its first MPV the Luxeed V9, debuting Spring 2026 with H1 launch. The "V" for Victory and "9" for flagship status promise space-focused design on E0X-L platform.

Highlights:

- Dimensions: ~5,300 mm long, ~2,000 mm wide; short overhangs maximize cabin.

- Tech Stack: Huawei Jujing battery, 800V SiC platform, 192-line lidar, Qiankun ADS for L3 driving (4 lidars), electric pop-up frunk.

- Powertrains: BEV (100 kWh, fast charging) and EREV (400 km pure EV range), CATL batteries.

Exterior teases full-width lights, roof lidar, Michelin tires, hidden rails—blending practicality and autonomy.

Why This Matters: Global Implications for EV Evolution

NIO's EREV critique and swap profitability challenge giants like BYD and upcoming Luxeed, which embrace large-battery EREVs. As China's NEV market—led by BYD's PHEV/BEV mix—grows, battery swapping could export as infrastructure lags abroad. Tesla's rebound signals competition heating up, while Huawei's ADS pushes L3 autonomy boundaries. This convergence of cost efficiency, infrastructure, and tech foreshadows a mature EV era beyond range wars.

Looking Ahead: Swaps vs. Batteries in China's EV Future

NIO's break-even push in Q4 2025 via swaps contrasts EREV reliance, potentially influencing global players. Watch Luxeed V9 sales to gauge Huawei MPV appeal, and BYD's response to swap economics. As 40% of Onvo buyers downsize batteries, expect industry pivots toward flexible, profitable ecosystems over brute capacity.

Original Sources

Related Articles

Chinese EVs Dominate: Record Sales, AI Advances & Factory Milestones

Global EV sales smashed records at 2 million units in November 2025, with China's 1.32 million dominating amid BYD export highs and Tesla Shanghai's 400 millionth car. Funding surges for Deepal (6.12B RMB) and JAC (3.5B RMB) fuel smart platforms, while AI advances like DeepMind's 2028 AGI odds and具身智能 breakthroughs promise L4 'space robots.' EU price talks ease tariff fears, positioning Chinese EVs for global leadership.

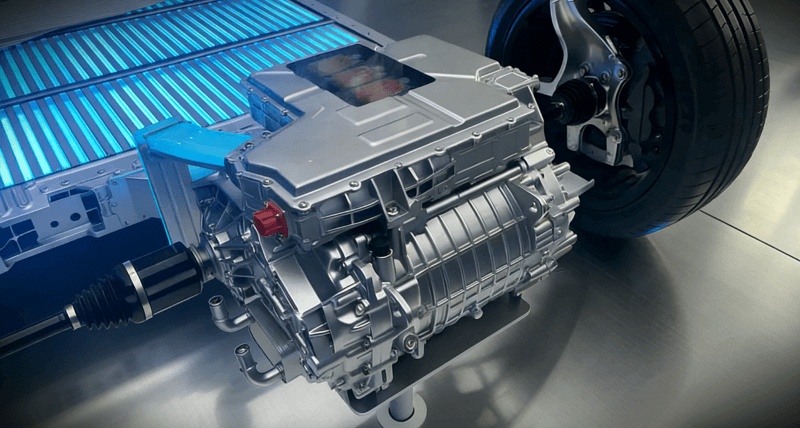

BYD's Breakthrough VF-PMSM Patents Revolutionize EV Motors

BYD's four new VF-PMSM patents enable dynamic flux adjustment for superior EV motor efficiency across speeds, potentially adding real-world range without bigger batteries. Outpacing Tesla's fixed-flux tech, this bolsters China's 35% global EV dominance. A game-changer for affordable, long-range electric vehicles worldwide.