Chinese EVs Dominate: Record Sales, AI Advances & Factory Milestones

Global EV sales smashed records at 2 million units in November 2025, with China's 1.32 million dominating amid BYD export highs and Tesla Shanghai's 400 millionth car. Funding surges for Deepal (6.12B RMB) and JAC (3.5B RMB) fuel smart platforms, while AI advances like DeepMind's 2028 AGI odds and具身智能 breakthroughs promise L4 'space robots.' EU price talks ease tariff fears, positioning Chinese EVs for global leadership.

In a blockbuster week for the Chinese electric vehicle (EV) industry, global EV sales hit a record 2 million units in November 2025—up 21% year-over-year—with China leading at 1.32 million retail sales, fueled by BYD's export record of 131,935 vehicles. Tesla's Shanghai Gigafactory rolled off its 400th millionth car in just six years, while domestic players like Changan's Deepal and JAC's Zunjie secured billions in funding for smart EV platforms. Amid AI hype from DeepMind's AGI predictions and具身智能 breakthroughs, these developments underscore China's grip on the EV market despite EU trade tensions.

Global EV Sales Surge with China at the Helm

Benchmark Mineral Intelligence reports November 2025 global EV sales reached 2 million units, pushing year-to-date totals to 18.5 million—a 21% increase. China dominated with 1.32 million retail sales (up 4.2% YoY), accumulating 11.47 million for the year (19.6% growth). BYD shattered export records at 131,935 units.

Europe countered U.S. stagnation with 36% YoY growth (BEV +35%, PHEV +39%), hitting 3.8 million YTD (+33%). North America slumped 42% in November due to expired tax credits, marking its first annual decline since 2019.

| Region | Nov 2025 Sales | YoY Growth | YTD Sales (millions) | YTD Growth |

|---|---|---|---|---|

| Global | 2M | +21% | 18.5 | +21% |

| China | 1.32M | +4.2% | 11.47 | +19.6% |

| Europe | N/A | +36% | 3.8 | +33% |

| North America | ~100K | -42% | Flat/Decline | N/A |

Tesla Shanghai Hits 400 Million Milestone

Tesla's Shanghai Gigafactory celebrated its 400th vehicle rollout on December 8—achieved in under 14 months from the 300th. Contributing nearly half of Tesla's global deliveries with 95%+ localization, the factory produces a car every 30 seconds at 950,000 annual capacity (40% of Tesla's total). November China sales rose 9.9% to 86,700 units, with Model 3/Y up 41% MoM, spotlighting the new starlight gold Model Y Long Range.

Domestic Funding Fuels EV Innovation

- Changan Deepal: Securing ~6.12 billion RMB via equity expansion; Changan invests up to 3.12 billion, maintaining 51% control for advanced platforms.

- JAC Motors: Approved for 3.5 billion RMB issuance to fund a 5.875 billion smart EV platform, backing Huawei-backed Zunjie S800 (18,000 orders in 175 days) and future SUV/MPV models.

- Geely-Zeekr Merger: Nears completion by Dec 29, 2025; 70.8% shareholders opt for shares, others get $701M cash, unifying resources for global luxury NEVs.

- Li Auto Materials Mastery: Leads industry with full-spectrum self-developed materials (steel, alloys, plastics); UFHS-X tank steel boasts 100% higher yield strength at 6x cost.

AI and Robotics Reshape Chinese EVs

AGI looms with DeepMind's Shane Legg predicting 50% chance by 2028 for 'minimal viable AGI'—systems matching human cognition. China's AI core industry eyes 1.2 trillion RMB by 2025 (+24% in 2024), powering manufacturing (25.9% model apps) and wearables (+23.1%).

EV-adjacent breakthroughs:

- Chery Moxia: 1,000th Argos robot dog delivered for patrol/companionship (6.48km range, 5kg payload).

- Zhiyuan: 5,000th general embodied robot offline, spanning 8 scenarios.

- Horizon Robotics: Open-sources HoloMotion (motion) and HoloBrain (perception) models.

- Li Auto: Plans directionless L4 vehicle in 3 years, eyeing AI 'space robots' by 2030.

Trade Tensions and Global Partnerships

China-EU talks resume on minimum export price mechanisms to replace 45.3% tariffs, amid claims of subsidy-driven overcapacity. Elsewhere, Renault-Ford partner on two Ampere-platform EVs for Europe (2028 launch) and vans, sharing costs in a shifting landscape.

Why This Matters: Global Implications

China's EV dominance—11.47 million sales YTD—highlights supply chain mastery and export prowess, pressuring Europe (33% growth) and stalling U.S. markets. Billions in funding (Deepal, JAC) and AI integrations signal a pivot to intelligent mobility, where具身智能 and L4 autonomy could redefine cars as 'space robots.' Tesla Shanghai's efficiency sets benchmarks, but EU negotiations will shape 2026 exports.

Looking Ahead

Expect Zeekr merger synergies, Zunjie expansions, and L4 pilots to accelerate. With AGI timelines shortening and robotaxi tests (Benz-Momenta in Abu Dhabi), 2026 could see Chinese EVs export not just vehicles, but AI-driven ecosystems—reshaping global competition.

Original Sources

Related Articles

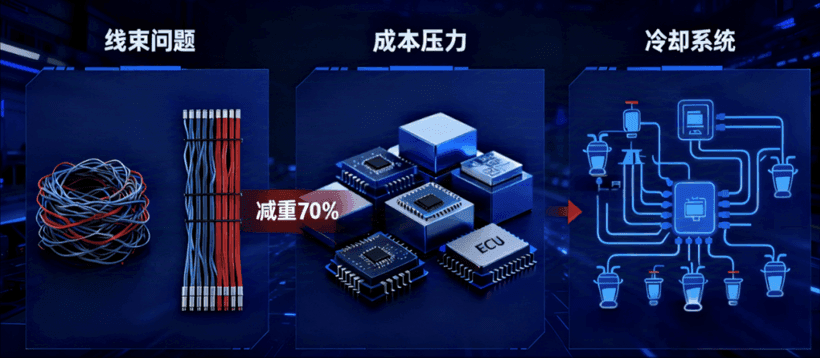

China EV News: XCU Hits 500K, L3 Approval, Power Deals

China's EV sector surges with Jingwei Hengrun's XCU hitting 500K units on Geely Xingyuan, MIIT approving two L3 autonomous models from Changan and BAIC BluePark, and Dongan Power's strategic lab with BAIC Manufacturing for off-road NEVs. These breakthroughs tackle wiring costs, boost autonomy, and enhance powertrains amid 2024's 9.5M NEV output. They solidify China's lead in software-defined vehicles and global EV competition.

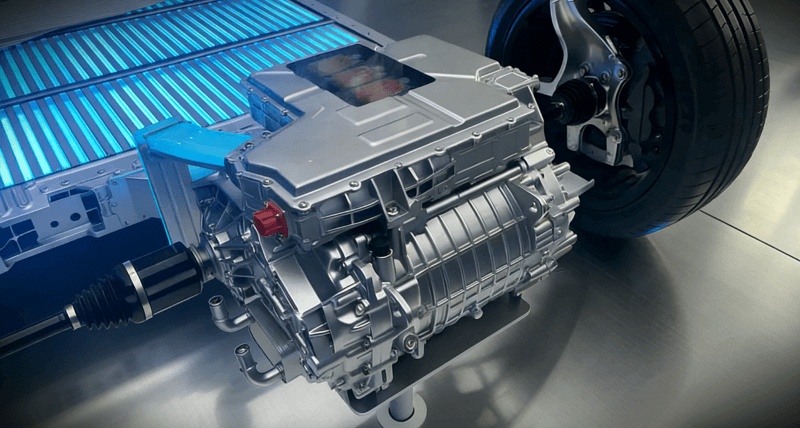

BYD's Breakthrough VF-PMSM Patents Revolutionize EV Motors

BYD's four new VF-PMSM patents enable dynamic flux adjustment for superior EV motor efficiency across speeds, potentially adding real-world range without bigger batteries. Outpacing Tesla's fixed-flux tech, this bolsters China's 35% global EV dominance. A game-changer for affordable, long-range electric vehicles worldwide.