BYD's Breakthrough VF-PMSM Patents Revolutionize EV Motors

BYD's four new VF-PMSM patents enable dynamic flux adjustment for superior EV motor efficiency across speeds, potentially adding real-world range without bigger batteries. Outpacing Tesla's fixed-flux tech, this bolsters China's 35% global EV dominance. A game-changer for affordable, long-range electric vehicles worldwide.

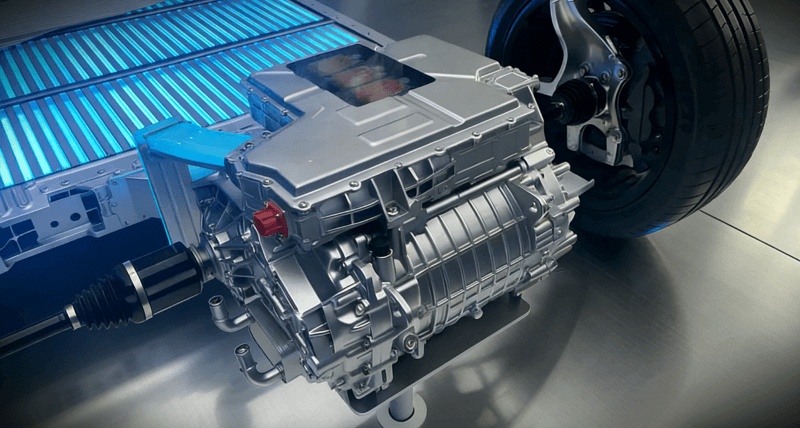

BYD, China's EV powerhouse, has unveiled four key patents for Variable Flux Permanent Magnet Synchronous Motor (VF-PMSM) technology, published by China's National Intellectual Property Administration (CNIPA) in December 2025 after filing in May 2024. These innovations (CN121055622A, CN121055630A, CN121055623A, CN121055631A) enable dynamic rotor magnetic flux adjustment, boosting efficiency across low- and high-speed operations. This move signals BYD's aggressive push to outpace competitors in motor tech, potentially extending EV range without larger batteries.

What is VF-PMSM Technology?

Traditional permanent magnet synchronous motors (PMSMs) dominate EVs like Tesla's but suffer fixed flux limitations: powerhouse torque at low speeds, yet efficiency drops at highway paces due to back-EMF (counter-electromotive force). VF-PMSM solves this by dynamically tweaking rotor flux:

- Low speeds: Maximize flux for peak torque.

- High speeds: Reduce flux to cut losses and sustain efficiency.

Benefits include:

- Up to 10-20% efficiency gains (based on industry benchmarks from similar tech).

- Extended high-speed range.

- Optimized torque without battery upsizing.

BYD's patents detail practical rotors: movable magnetic regulation components (CN121055630A), axial flux adjusters (CN121055623A), and radial magnetic conductive tweaks (CN121055631A).

Patent Breakdown: BYD's Technical Edge

| Patent Number | Key Innovation | Efficiency Impact |

|---|---|---|

| CN121055622A | Flux-adjustment integrated with motor/drive system | Broad operating range expansion |

| CN121055630A | Movable magnetic regulation relative to rotor | Enlarged high-efficiency zones |

| CN121055623A | Axial adjustment assembly for rotor flux | Precise low-to-high speed transitions |

| CN121055631A | Radial magnetic conductive area tuning | Fine-tuned flux control |

These build on BYD's prior variable flux work, with ongoing filings in rotors, stators, and powertrains underscoring relentless R&D.

Comparison to Western EV Motor Tech

Western giants lag in variable flux adoption:

- Tesla: Relies on high-efficiency fixed PMSMs (e.g., Plaid's carbon-wrapped magnets), hitting 95%+ peak efficiency but flux-weak at extremes. No public VF-PMSM patents.

- Lucid: Advanced axial-flux motors claim 20% range edge, yet fixed flux limits versatility.

- GM/Rivian: SiC inverters boost efficiency, but motors stick to conventional PMSMs.

| Feature | BYD VF-PMSM | Tesla PMSM | Lucid Axial-Flux |

|---|---|---|---|

| Flux Adjustability | Dynamic (low/high speed) | Fixed | Fixed |

| Efficiency Range | Broad (claimed 10-20% gain) | Peak 95%+ (narrow) | 20% range boost (specific) |

| Commercial Status | Patented (2025) | Production | Production |

BYD's approach mirrors its Blade Battery dominance—cost-effective, scalable innovation from China's supply chain.

Global Implications: Why This Matters for EVs

BYD's VF-PMSM patents intensify China's EV lead, where it commands 35%+ global BEV/PHEV share (2024 CnEVPost data). For Western readers:

- Range Anxiety Killer: Efficiency gains could add 30-50 miles real-world range, rivaling solid-state battery hype.

- Cost Pressure: Patents enable cheaper motors (rare earths optimized), undercutting Tesla's $40k+ pricing.

- Tech Race: No commercial VF-PMSM yet, but BYD's Seagull/Han models may integrate by 2026, pressuring GM/Ford to innovate.

This fits China's 2024 patent surge (60% of global EV filings), fueling exports like BYD's Brazil/Ukraine plants.

Looking Ahead: BYD's Next Powertrain Leap

Expect VF-PMSM in 2026+ models, paired with e-Platform 3.0's 800V SiC. If efficiency hits 97% system-wide, BYD could claim 600+ km WLTP ranges at sub-$20k prices—global disruption incoming. Watch for prototypes at Auto Shanghai 2025. Western OEMs: innovate or import?

Original Sources

Related Articles

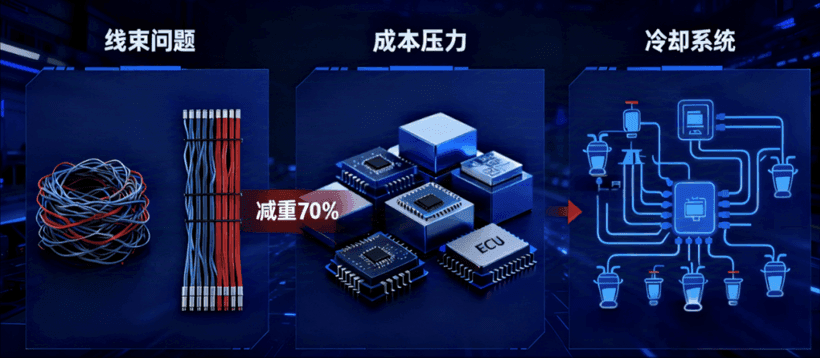

China EV News: XCU Hits 500K, L3 Approval, Power Deals

China's EV sector surges with Jingwei Hengrun's XCU hitting 500K units on Geely Xingyuan, MIIT approving two L3 autonomous models from Changan and BAIC BluePark, and Dongan Power's strategic lab with BAIC Manufacturing for off-road NEVs. These breakthroughs tackle wiring costs, boost autonomy, and enhance powertrains amid 2024's 9.5M NEV output. They solidify China's lead in software-defined vehicles and global EV competition.

Chinese EVs Dominate: Record Sales, AI Advances & Factory Milestones

Global EV sales smashed records at 2 million units in November 2025, with China's 1.32 million dominating amid BYD export highs and Tesla Shanghai's 400 millionth car. Funding surges for Deepal (6.12B RMB) and JAC (3.5B RMB) fuel smart platforms, while AI advances like DeepMind's 2028 AGI odds and具身智能 breakthroughs promise L4 'space robots.' EU price talks ease tariff fears, positioning Chinese EVs for global leadership.