Adient's China Seat JV Signals Foreign Supplier Surge Amid EV Shift

Adient's 49% stake in China's Shutzman forms a key JV for advanced EV seats, exemplifying foreign Tier 1s' China rush amid global ICE revival (EY: 50% consumer shift). This fusion enhances Chinese EV interiors while navigating tariffs and policy wobbles. Deeper localization promises tech upgrades for BYD, NIO, and beyond.

Global automotive supplier Adient has acquired 49% equity in China's Shutzman Automotive Seat Manufacturing (Zhangjiakou), forming a strategic joint venture renamed Shutzman Adient (Zhangjiakou) Automotive Components Co., Ltd. Announced recently, this move deepens Adient's footprint in China's booming EV market, blending its global seat tech expertise with local market savvy. Meanwhile, global EV momentum faces headwinds as consumer interest shifts back to ICE vehicles, per EY reports, highlighting tensions in the transition to electric mobility.

Adient-Shutzman JV: Tech Fusion for China's EV Seat Demand

This isn't just a capital tie-up—it's a powerhouse merger of Adient's cutting-edge seat innovation and Shutzman's China-centric operations. The JV, based in Zhangjiakou, Hebei, targets high-end, innovative auto seats for major domestic OEMs like BYD, NIO, and XPeng.

Key details:

- Equity split: Adient holds 49%; Shutzman retains control.

- Business scope: Auto parts manufacturing, mechanical processing, tech services, industrial design, warehousing, and import/export.

- Strategic focus: R&D and mass production of forward-looking seats aligned with EV comfort, intelligence, and global trends.

Adient gains agile local production to boost market share, while injecting global standards into China's supply chain. This JV exemplifies foreign Tier 1 suppliers' playbook: localize to compete with rising Chinese natives in seats, chassis, and ADAS hardware.

Broader Foreign Tier 1 Push into China

Adient's deal mirrors a wave of FDI in China's auto ecosystem, driven by the world's largest auto market (China's NEV penetration leads globally) and fierce local competition.

| Strategy | Examples | Benefits |

|---|---|---|

| Joint Ventures | Adient-Shutzman | Tech + local resources for quick market entry |

| R&D Centers | Hyundai Mobis in India (analogous trend); intl firms in Shanghai/Shenzhen | Tailored smart cockpit/ADAS solutions |

| Local Factories | Expansions in Yangtze/ Pearl River Deltas | Cost cuts, supply stability for EV boom |

This counters Chinese firms' edge in batteries, motors, and chips, fostering hybrid competitiveness.

Global EV Headwinds: ICE Revival and Policy Shifts

Contrasting China's EV surge, EY's December 9 report reveals waning global enthusiasm:

- 50% of consumers eye new/used ICE cars in next 24 months (up 13% from 2024).

- BEV preference drops 10% to 14%; hybrids down 5% to 16%.

- 36% of EV intenders delaying due to geopolitics.

Policy pivots amplify this:

- Trump pushes U.S. fuel economy rollbacks.

- EU mulls softening 2035 ICE ban.

- Mexico eyes 50% tariffs on Chinese autos.

- Renault backs EU local content for EVs but warns against high thresholds.

Other news: LG Energy Solution inks $1.4B battery deal with Mercedes (2028-2035); Tesla FSD launches in Korea (7th market).

Why This Matters: Implications for Chinese EVs

For China's EV giants, foreign inflows like Adient's JV mean upgraded interiors—critical for premium models from Zeekr or Li Auto—elevating comfort in smart cockpits. Yet global ICE resurgence pressures exports amid tariffs, underscoring China's dual strength in NEVs and ICE (e.g., BYD's Japan microvan challenge via Nissan's Roox orders).

This synergy boosts China's chain: foreign tech uplifts locals, spurs high-quality EVs, and tests innovations for global export.

Looking Ahead: Resilient EV Transformation

Despite ICE flickers, China's NEV dominance endures—expect more JVs accelerating intelligent, sustainable mobility. Adient's bet signals confidence: China's market will drive global auto evolution, with EVs at the core. Watch for supply chain integrations powering next-gen models from XPeng's autonomous tech to NIO's battery swaps.

Original Sources

Related Articles

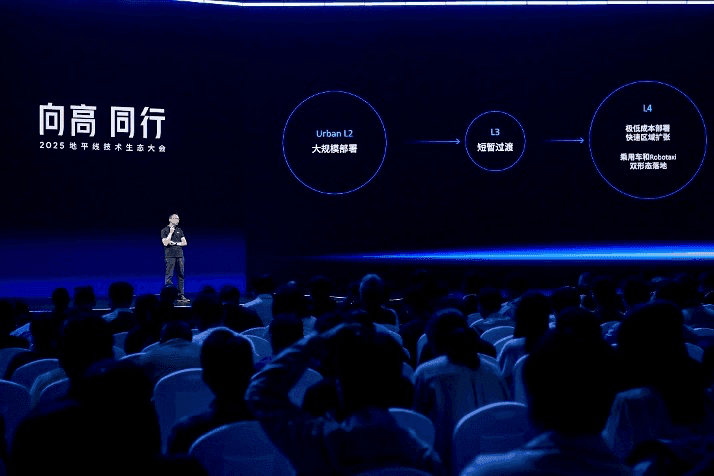

Horizon HSD Revolution: China's ADAS Set for L4 Leap

Horizon's Su Qing predicts end-to-end ADAS like HSD will deliver human-like L2 in 100k RMB cars within a year and nationwide L4 at passenger prices in 2-3 years, echoing Tesla FSD V12's revolution. Zhixing Tech lands five parking projects, four overseas, with 8TOPS BEV tech boosting global reach. This duo signals China's smart driving tech dominating EVs worldwide.

China EV Buzz: QNX Summit, Nio Rival Bust, N6 Hits 10K Orders

QNX's Shanghai summit unveiled ASIL D-certified SDV tech with partners like Geely, powering China's EV software shift. Dongfeng Nissan's N6 PHEV SUV smashed 10,000 orders in 10 days, fueling hybrid demand. XPeng secured a police win against AI deepfakes, highlighting digital risks in the booming Chinese EV market.