BYD Hits 15M NEVs, Leaks FCB Sedan as Momenta Eyes Global AD

BYD celebrates 15 million NEVs produced, outstripping Tesla and VW, fueled by hits like Dolphin and Seagull. Spy shots leak the FCB Magnesium 9 sedan with LiDAR for 2026, while Momenta bags Grab investment to push robotaxis in Southeast Asia. These moves spotlight China's EV production dominance and global AD expansion.

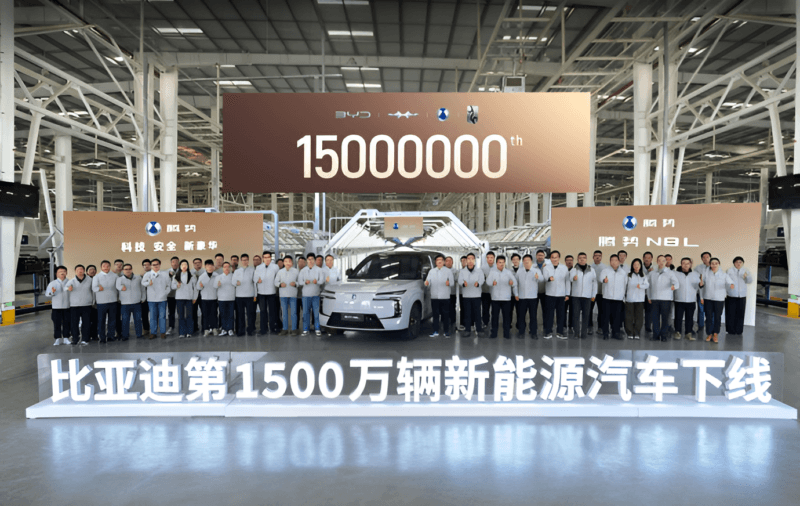

In a landmark achievement announced on December 18, 2025, BYD has rolled off its 15 millionth New Energy Vehicle (NEV), surpassing Tesla's 8.1 million cumulative BEV production and Volkswagen Group's under 3 million BEVs and PHEVs. This milestone, reached just eight months after hitting 13 million units, underscores BYD's explosive growth in China's EV market. Meanwhile, spy shots reveal BYD's premium FCB brand's first sedan, the Magnesium 9, set for a 2026 launch, while autonomous driving startup Momenta secures investment from Southeast Asian giant Grab to expand robotaxi tech.

BYD's 15 Million NEV Milestone: A Production Powerhouse

Founded in 1995 and entering autos in 2003, BYD phased out pure ICE vehicles in 2022 to focus on BEVs and PHEVs. The 15 millionth NEV caps rapid scaling: from 10 million in late 2024 to 13 million mid-2025, and now 15 million.

Key contributors include:

- Dolphin hatchback: Over 1 million units sold.

- Seagull (Dolphin Mini/Atto 1): Over 1 million units.

- High-volume SUVs like Song Plus and Sealion 06.

- Dynasty series: Qin, Song, and Tang.

These models drive BYD's domestic dominance and exports, bolstered by in-house battery, powertrain, and intelligent driving tech.

| Manufacturer | Cumulative Production | Notes |

|---|---|---|

| BYD | 15 million | BEVs + PHEVs |

| Tesla | 8.1 million | BEVs only |

| VW Group | <3 million | BEVs + PHEVs |

BYD's output represents a massive slice of China's 2025 global NEV production lead.

FCB Magnesium 9: BYD's Sleek Sedan Spy Shots Emerge

Launched in 2023, BYD's FCB brand (Denza internationally) has thrived with Titanium urban SUVs and Beast off-roaders. Now, leaked images tease the Magnesium 9, FCB's first sedan for China, targeting a 2026 debut in the mid-to-large GT segment.

Highlights from prototypes:

- Fastback roofline with sporty coupe profile.

- Wide stance, new headlights, and grille.

- Dual character lines tapering to C-pillar.

- Large wheels with distinct front/rear designs.

- Roof-mounted LiDAR hinting at God's Eye B ADAS for highway pilot and urban navigation.

Positioned above FCB SUVs, it expands appeal in China's sedan market. Specs like powertrain, battery, and pricing remain unconfirmed.

Momenta's Grab Investment: Chinese AD Tech Goes Global

Suzhou-based Momenta, founded in 2016, landed strategic funding from Grab (NASDAQ: GRAB) on December 18, 2025, following WeRide's Grab deal. The partnership targets Southeast Asia's dense urban robotaxi deployment.

Momenta's edge:

- Unified software for L2 (mass-produced cars) and L4 (robotaxi) using stock vehicles—no retrofits needed.

- Partners: Mercedes-Benz, BMW, SAIC, GM, Toyota, Bosch, Uber.

- Expanding robotaxi R&D to commercial fleets in China, Germany, Japan, US.

Co-founder Ren Shaoqing's NIO stint bolsters its credentials in the competitive Chinese autonomous driving race.

Why This Matters: Global Implications for Chinese EVs

BYD's 15M milestone cements China's EV supremacy, with NEV tech integration outpacing Western rivals amid falling battery costs and policy support. The FCB Magnesium 9 signals premium sedan ambitions, challenging NIO, XPeng, and Zeekr in luxury segments. Momenta's Grab tie-up accelerates Chinese ADAS and robotaxi exports to Southeast Asia, where Grab's ride-hailing dominance offers scale.

Together, these developments highlight China's EV ecosystem: vertical integration (BYD), brand diversification (FCB), and AD innovation (Momenta), pressuring Tesla and legacy OEMs globally.

Looking Ahead: 2026 and Beyond

Expect BYD to hit 20 million NEVs by late 2026, with Magnesium 9 details at auto shows. Momenta's Grab collab could launch robotaxis in Singapore by 2027, rivaling Waymo. Watch for intensified competition as Chinese EVs flood exports, driving down prices and upping tech standards worldwide.

Original Sources

Related Articles

Xiaomi's AI Leap & BYD's L3 Test: China EV Surge

Xiaomi's MiMo-V2-Flash AI model promises 'living' agents for EVs, while BYD advances L3 testing after 150,000+ km and confirms 16.5% PHEV efficiency gains via OTA. XPeng predicts L4 autonomy soon amid no AI bubble, as Ideal and peers crush smear campaigns. These moves highlight China's EV AI surge against Tesla and global rivals.

Chinese EVs Reshape Global Markets: India, Europe, Middle East

Chinese EVs drive global shifts: Maruti Suzuki's e VITARA eyes 45% alternative fuel share in India by 2027 with $28M infra push, as BYD/Chery claim 6.8% Europe market amid supplier layoffs. Faraday Future advances Middle East deliveries, underscoring China's ecosystem influence. EV penetration grows despite hurdles, forecasting 16% India sales rise in 2026.