2025 China SUV Shakeup: Tesla Slips, Geely Surges Amid EV Shifts

Tesla Model Y holds China's 2025 SUV sales crown at 420K units despite 13% drop, as Geely's Xingyue L and Boyue L explode with 258K/257K sales via killer pricing and hybrids. BYD falters with 50%+ declines on key models, while Leapmotor C10 and Aito M8 emerge as EV stars; GAC's BU mergers signal traditional OEM reinvention. This shakeup underscores hybrids' resilience in the world's largest EV market.

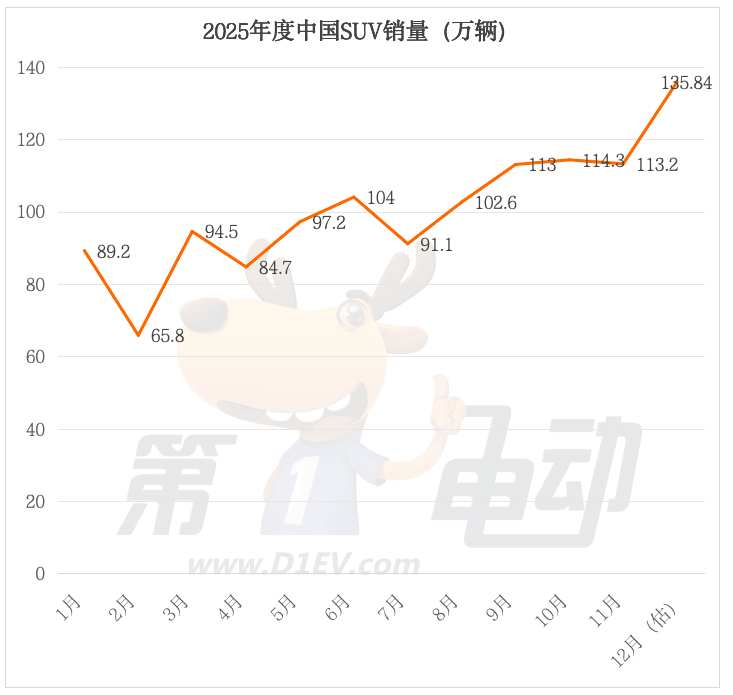

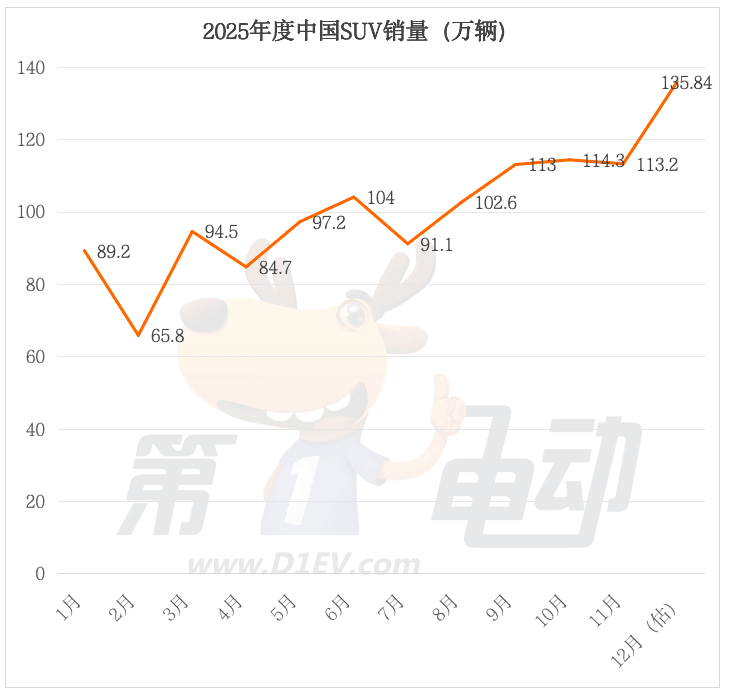

In 2025, China's SUV market underwent a dramatic restructuring, with total retail sales projected at 1.21 million units for the year—a 6.6% YoY increase—driven by surging demand and a mix of EV innovation and resilient ICE models. Tesla's Model Y clung to the top spot with ~420,000 units sold but faced a 13% sales drop amid fierce domestic competition, while Geely's Xingyue L and Boyue L roared back with 258,000 and 257,000 units respectively, marking gains of 17% and 121%. This shift highlights intensifying battles between EVs, hybrids, and traditional fuel vehicles, as Broadcom's BU reforms and global tech trends like SDV frameworks add layers to the evolving landscape.

SUV Sales Top 20: A Tale of Divergence and Resilience

China's passenger vehicle retail hit 21.46 million units in Jan-Nov 2025 (up 29% YoY), with SUVs claiming 10.7 million (50% share, +5.7%). December estimates push annual SUV volume to 1.21 million. The Top 20 list reveals stark changes:

| Rank | Model | Brand | Est. 2025 Sales (000s) | YoY Change |

|---|---|---|---|---|

| 1 | Model Y | Tesla | 420 | -13% |

| 2 | Xingyue L | Geely | 258 | +17% |

| 3 | Boyue L | Geely | 257 | +121% |

| 4 | Tiguan L | VW | 205.5 | +20% |

| 5 | RAV4 Rongsong | Toyota | 219 | +13% |

| 6 | M8 | Aito | 150 | New entrant |

| 7 | C10 | Leapmotor | 140 | New black horse |

| ... | Song PLUS | BYD | N/A | -50%+ drop |

| 19 | Yuan PLUS | BYD | N/A | Down from top 10 |

- Key Shifts: NEVs hold only 8 Top 20 spots (down from 9 in 2024), with ~3.9M units (-6% YoY). BYD's Song PLUS and Yuan PLUS halved sales due to product aging and internal cannibalization (e.g., Sea Lion 06).

- ICE/HEV Comeback: Geely's duo dominates with affordable pricing (Boyue L from ~90K RMB post-discount) and features like L2 ADAS, proving hybrids thrive where charging lags.

- Rising Stars: Leapmotor C10 (12-14M RMB) offers 1190km range (EREV) and LiDAR; Aito M8 (36-45M RMB) boasts HarmonyOS cockpit and 10K orders in 24 hours post-launch.

Native brands claimed 12 Top 20 slots (up 1), while JVs slipped to 7.

EV Camp Polarization: Winners, Losers, and Broader Trends

NEV SUVs show 'ice and fire':

- Black Horses: Leapmotor C10's 'high-end specs for the masses'—8295mm wheelbase, 835L trunk, 800V fast charge—delivered 150K units in 16 months. Aito M8 targets premium families with quad-motor AWD.

- BYD Struggles: Core models like Song PLUS lost ground to rivals' smarter tech and Geely's pricing wars, plus owner backlash from past price cuts.

- ICE Holdouts: VW Tiguan L and Toyota RAV4 rely on reliability and service networks, underscoring incomplete NEV infrastructure.

Market concentration dipped as competition fragmented, with 2024 top dogs like Ideal L6 and BYD Song Pro tumbling out of Top 10.

GAC's 'Panyu Action': Restructuring for Survival

Facing 2024's first loss and 2.54B RMB H1 2025 deficit, GAC launched 'Panyu Action'—merging Haobo and Aion into one BU for shared resources and 1000+ dual-brand stores by 2026. Haobo ramps PHEV focus; new 'Qijing' brand (with Huawei) targets 300K+ RMB premium EVs in 2026. This addresses Aion's C-segment smart tech gaps and Haobo's channel woes, mirroring industry pushes toward agility.

Global Tech Pulse: Fueling China's EV Evolution

Amid SUV chaos, global innovations align with China's smart shift:

- ADAS/Safety: Seeing Machines' 'attention sharing' for fleets; Ford patents for pedestrian barriers, call screening, hidden object detection.

- Storage & SDV: Micron's 2GB/s UFS 1 for AI/ADAS; HERE's SDV maturity framework (4 stages from connectivity to ecosystems).

- Connectivity: Sinclair 5G antennas, Iteris priority systems for buses/emergency vehicles; SoundHound AI parking agents.

These bolster China's LiDAR-heavy, voice-AI C10/M8 models.

Why This Matters: Global Implications

China's 2025 SUV market—50% of 21M+ PV sales—signals hybrids/ICE's staying power (e.g., Geely's surge) despite NEV push, challenging Tesla/BYD dominance. GAC's reforms echo traditional OEMs' scramble against nimble natives like Leapmotor. Globally, it tempers EV hype: infrastructure gaps sustain HEVs, while SDV tech (HERE, Qt) arms China for export dominance. U.S./EU tariffs may redirect 1M+ units, pressuring Western incumbents.

Looking Ahead: Hybrid Dominance and Smart Bets

Expect 2026 TOP20 refresh with GAC's Qijing, Leapmotor expansions, and BYD relaunches. Hybrids could claim 40%+ share as PHEVs like Boyue L bridge anxieties. Winners will blend affordability, 1000km+ range, and L2+/LiDAR—watch Geely, Leapmotor, Aito. For investors, native brands' 60% TOP20 grip signals a multipolar EV era.

Original Sources

Related Articles

BYD Hits 15M EVs as Li Auto Bets Big on Silicon Valley AI

BYD celebrates its 15 millionth NEV amid 4.18M sales in 11 months, while Li Auto launches a Silicon Valley AI center for autonomous driving breakthroughs. NIO's ES8 hits 30k deliveries in 89 days, CATL deploys humanoid robots tripling battery output, and Aito offers tax subsidies as China's EV leaders pivot to AI dominance. These moves signal a global tech arms race reshaping the industry.

2025 China SUV Shakeup: Tesla Slips, Geely Surges

China's 2025 SUV market saw Tesla Model Y hold #1 at 420,000 units despite a 13% drop, while Geely's Xingyue L and Boyue L exploded to 2nd/3rd with 258k/257k sales. NEVs like Aito M8 and Leapmotor C10 rose as black horses, but BYD models halved; fuel/hybrids proved resilient in a 12.1M-unit market. GAC's reforms and global tech trends signal intensifying smart EV battles.