BYD, XPeng Lead Chinese EV Charge on Pricing Rules, Defamation Wins

China's SAMR unveiled auto pricing guidelines on December 12, 2025, prompting BYD, XPeng, NIO, and GWM to pledge transparency amid EV market turbulence. Courts simultaneously awarded these brands up to $283,000 USD in defamation wins against fake news creators. These moves signal a maturing Chinese EV sector focused on consumer trust and reputation defense.

China's electric vehicle giants like BYD, XPeng, NIO, and Great Wall Motor (GWM) are swiftly aligning with new regulatory mandates while securing major court victories against online defamation. On December 12, 2025, the State Administration for Market Regulation (SAMR) released the 'Automobile Industry Price Behaviour Compliance Guidelines (draft for comments),' demanding transparent pricing, clear optional accessory details, and upfront delivery timelines. Major EV makers including BYD, XPeng, and BAIC issued supportive statements, signaling industry-wide compliance amid a competitive shake-up. Simultaneously, courts awarded BYD up to 2 million yuan in defamation cases, underscoring Beijing's crackdown on fake news targeting Chinese EVs.

New Pricing Guidelines: Transparency Takes Center Stage

The SAMR's draft aims to curb price fraud, regional disparities, and unfair practices in China's booming auto market, where EVs dominate sales. Key requirements include:

- Mandatory clear pricing: All vehicles and services must display exact prices, including optional accessories' names, specs, prices, and origins.

- Delivery transparency: Non-immediate deliveries require explicit timelines before transactions.

- Compliance frameworks: Automakers must build internal monitoring systems, training programs, and reporting mechanisms.

BYD pledged to optimize its price management, prevent fraud, and lead by example. XPeng, NIO, GWM, and BAIC echoed this, promising standardized pricing across channels to boost consumer trust.

| Automaker | Response Highlights | Potential Impact |

|---|---|---|

| BYD | Optimize compliance systems; anti-fraud focus | Sets industry benchmark for EV pricing |

| XPeng | Full alignment with guidelines | Reduces dealer promo flexibility |

| NIO | Commit to fair competition | Enhances supply chain sustainability |

| GWM | Support transparent practices | Limits price collusion risks |

| BAIC | Response to draft | Boosts smaller firms' admin costs |

Analysts predict these rules will standardize EV pricing nationwide, curbing sudden hikes and building trust in a market projected to exceed 10 million annual EV sales by 2026.

Court Victories Against Defamation: Protecting EV Reputations

In a parallel push against online misinformation, Chinese courts delivered stinging rebukes to defamatory creators. China Central Television highlighted finalized rulings:

- BYD vs. Longzhu Jiche: Account spread false spontaneous combustion claims using edited footage over 5 years. Court ordered content deletion, public apology, and 2.0187 million yuan (~$283,000 USD) compensation for reputation damage.

- GWM vs. Dayange Shuoche: Derogatory posts exceeded oversight bounds. Result: Video removal, apology, 200,000 yuan (~$28,000 USD) payout.

- XPeng vs. Long Laoshi Jiang Dianche: Unverified battery ingress and warranty refusal claims ruled false. Ordered deletions, multi-platform apology, 100,000 yuan (~$14,000 USD) compensation.

Additionally, police detained an individual for 10 days over an AI-generated fake XPeng video during the Guangzhou Auto Show, per Cyberspace Administration cases targeting coordinated smears and monetized falsehoods.

These wins align with Beijing's December 11 release of typical misconduct cases, deterring traffic-chasing attacks on EV brands amid fierce competition.

Why This Matters: Global Implications for Chinese EVs

These developments reinforce China's EV ecosystem resilience. Transparent pricing counters Western criticisms of opacity, aiding exports—BYD alone shipped over 400,000 vehicles abroad in 2025. Defamation crackdowns protect brands like XPeng and NIO from viral misinformation that hampers global perception, especially as tariffs loom in the US and EU.

In a market where EVs hit 50%+ penetration, standardized rules foster healthy rivalry, benefiting consumers with predictable costs and reliable info. Smaller players may struggle with compliance overheads, consolidating power among leaders like BYD (world's top EV seller).

Looking Ahead: A Transparent EV Future

Finalized guidelines could roll out by Q1 2026, prompting system overhauls. Expect more defamation suits as regulators wield AI-detection tools. For global buyers, this means fairer dealings with Chinese EV titans, accelerating adoption amid falling battery costs (down 20% YoY). Watch BYD and XPeng for compliance innovations that could redefine the $500B+ global EV race.

Original Sources

Related Articles

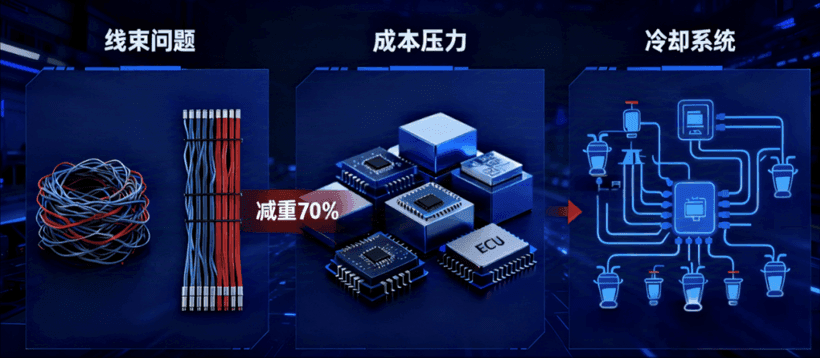

China EV News: XCU Hits 500K, L3 Approval, Power Deals

China's EV sector surges with Jingwei Hengrun's XCU hitting 500K units on Geely Xingyuan, MIIT approving two L3 autonomous models from Changan and BAIC BluePark, and Dongan Power's strategic lab with BAIC Manufacturing for off-road NEVs. These breakthroughs tackle wiring costs, boost autonomy, and enhance powertrains amid 2024's 9.5M NEV output. They solidify China's lead in software-defined vehicles and global EV competition.

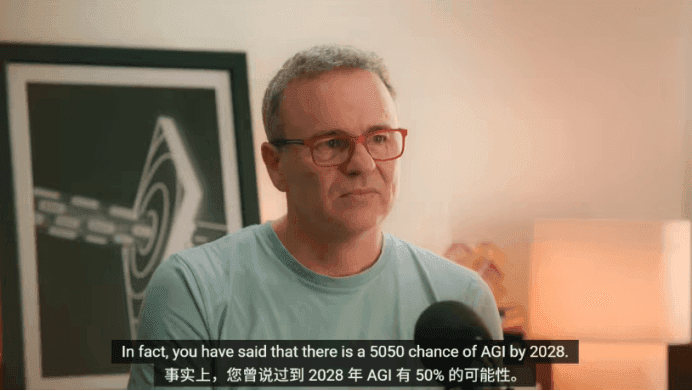

Chinese EVs Dominate: Record Sales, AI Advances & Factory Milestones

Global EV sales smashed records at 2 million units in November 2025, with China's 1.32 million dominating amid BYD export highs and Tesla Shanghai's 400 millionth car. Funding surges for Deepal (6.12B RMB) and JAC (3.5B RMB) fuel smart platforms, while AI advances like DeepMind's 2028 AGI odds and具身智能 breakthroughs promise L4 'space robots.' EU price talks ease tariff fears, positioning Chinese EVs for global leadership.