Chinese EV Sales Surge: Winners, Tariffs, and 2026 Plans

Leapmotor, Xiaomi, and XPeng have exceeded 2025 sales targets amid China's EV boom, with BYD and Geely poised to follow, but NIO and Great Wall lag. Mexico's 50% tariffs threaten exports, while Huawei's HarmonyOS alliance plans 10+ 2026 models and L3 driving. This mix of triumphs and tensions highlights China's EV market's global pivot.

As 2025 draws to a close, China's electric vehicle (EV) market reveals stark divides: Leapmotor, Xiaomi, and XPeng have already smashed their annual sales targets, while giants like BYD and Geely cruise toward success. Yet, challenges loom with Mexico's new 50% tariffs on Chinese EVs threatening export growth, even as Huawei's HarmonyOS alliance gears up for a massive 2026 offensive with 10+ new models and L3 autonomy. This pivotal moment underscores China's EV dominance amid global headwinds and internal rivalries.

2025 Sales Race: Early Victors and Steady Contenders

Front-11-months data from over 16 major automakers shows an average target completion rate of around 80%, but only about 40% are on track to fully hit their goals. The China Passenger Car Association (CAAM) forecasts total 2025 vehicle sales at 34 million units, yet combined targets exceed this, signaling intense competition and price wars.

Standout Achievers

Three new-energy forces have crossed the finish line early:

- Leapmotor: 536,000 units sold (107% of target), fueled by high "value-for-money" models like the new Lafa5 sedan and upcoming A10 with LiDAR.

- Xiaomi Auto: Over 355,000 deliveries (exceeding 350,000 goal) via SU7 and YU7, leveraging ecosystem integration despite capacity constraints.

- XPeng: 392,000 units (156% YoY growth, beating 350,000 target) thanks to MONA M03, G7, and improved intelligence.

These winners share smart pricing, leading-edge ADAS, and efficient supply chains.

Safe Bets for Year-End

Car makers with 80-93% completion rates face manageable December pushes:

| Carmaker | Jan-Nov Sales (000s) | Target Completion | Dec Target Needed (000s) | Notes |

|---|---|---|---|---|

| BYD | 4,180 | 91% | ~400 | Hybrid/exports strong |

| SAIC | 4,110 | >90% | ~390 (for 4.5M total) | Domestic + 1M exports |

| Geely | 2,780 | 93% | ~220 (upped to 3M) | Galaxy series at 1.135M |

| Changan | ~2.65M (est.) | ~88% | 350 | NEVs at 990k, near 1M |

| FAW | 2,990 | ~87% | 460 | Red Flag key |

BYD's full-chain control and Geely's multi-energy strategy exemplify resilience.

Strugglers Facing Shortfalls

Lower performers like NIO (63% complete, needs impossible 160k in Dec for 440k goal), Li Auto, Great Wall (30% for 4M target), and Dongfeng lag due to lofty goals, weak new products, and slow NEV shifts. Great Wall's 1.2M sales highlight over-optimism from boom years.

Mexico Tariffs: A Global Export Hurdle

On December 10, Mexico's lower house passed a bill hiking tariffs up to 50% on Chinese EVs, parts, and goods from Asia (India, Korea, Thailand, Indonesia) starting 2026. Aimed at boosting local manufacturing and balancing trade—projected to add $3.76B in revenue—it awaits senate approval amid opposition from China and Mexico's auto sector.

This hits China's EV exporters hard, as Mexico serves as a USMCA bridge. With US pressures mounting (e.g., against transshipment), firms like BYD and Geely must pivot to new markets or localize production.

Huawei's HarmonyOS Offensive: 10+ Models and L3 Autonomy

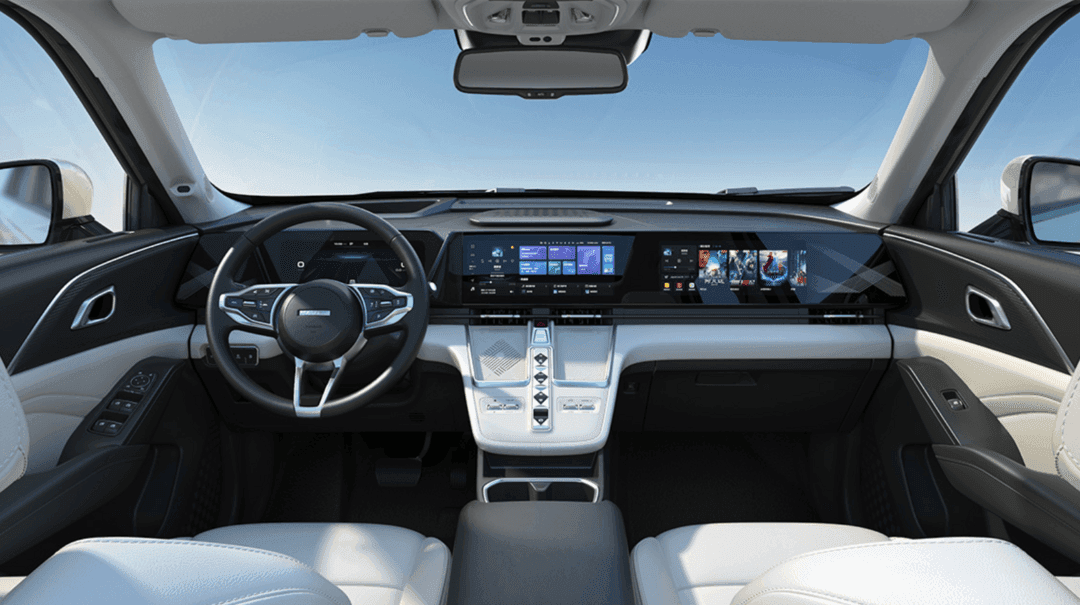

In a high-profile livestream, Huawei's Yu Chengdong rallied HarmonyOS partners (Ask界, 智界, 享界, 尊界, 尚界), unveiling aggressive 2026 plans:

- 10+ launches covering 150k-1M+ RMB: Ask界 M5/M7/M8 upgrades, new M6 (25-30万 gap-filler), M9L; 享界 hardtop SUV; 智界 V9 MPV ("best on road"); 尚界 15-25万 mainstream and coupe; 启境 sedan; 尊界 ultra-lux SUV/MPV.

- Autonomy push: L3 rollout in 2026, L4 by 2027 (regs permitting), enabling hands-off driving.

- Ambitious scale: Next 1M deliveries in just 10-12 months after recent 1M milestone.

Leaders like Chery's Yin Tongyue quipped against expansion ("basketball team, not soccer"), prioritizing tight integration over dilution.

Why This Matters: Global Implications

China's EV sales boom—NEVs driving structural shifts—contrasts with export barriers like Mexico's tariffs, potentially reshaping supply chains. HarmonyOS's blitz intensifies domestic rivalry, pressuring laggards like NIO while boosting intelligence standards. Globally, this cements China's 50%+ NEV penetration, challenging Tesla and legacy firms amid US/EU duties.

Looking Ahead

2026 pits surging innovation against trade walls: Winners like Leapmotor/XPeng will scale, BYD/Geely adapt exports, but strugglers risk consolidation. Huawei's L3 bet could redefine autonomy if regs align, propelling Chinese EVs to new heights. Watch December finals and tariff outcomes for clues.

Original Sources

Related Articles

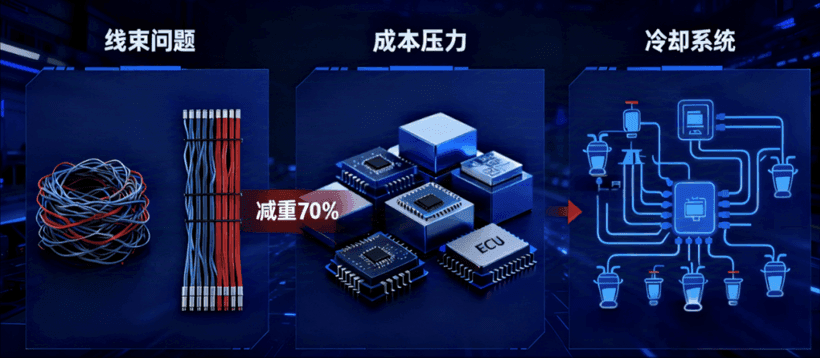

China EV News: XCU Hits 500K, L3 Approval, Power Deals

China's EV sector surges with Jingwei Hengrun's XCU hitting 500K units on Geely Xingyuan, MIIT approving two L3 autonomous models from Changan and BAIC BluePark, and Dongan Power's strategic lab with BAIC Manufacturing for off-road NEVs. These breakthroughs tackle wiring costs, boost autonomy, and enhance powertrains amid 2024's 9.5M NEV output. They solidify China's lead in software-defined vehicles and global EV competition.

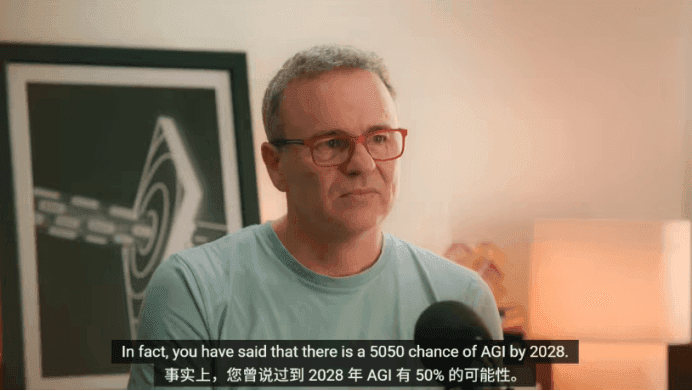

Chinese EVs Dominate: Record Sales, AI Advances & Factory Milestones

Global EV sales smashed records at 2 million units in November 2025, with China's 1.32 million dominating amid BYD export highs and Tesla Shanghai's 400 millionth car. Funding surges for Deepal (6.12B RMB) and JAC (3.5B RMB) fuel smart platforms, while AI advances like DeepMind's 2028 AGI odds and具身智能 breakthroughs promise L4 'space robots.' EU price talks ease tariff fears, positioning Chinese EVs for global leadership.