岚图梦想家销冠+理想NG-eCall: China EV Surge

Voiture's Mengxiangjia MPV topped November 2025 premium sales at 9,027 units with 400k RMB pricing, drawing 55% BBA switchers via 800V hybrid tech. Li Auto grabbed the first global NG-eCall 2024 cert for EU-ready safety, while Haosi Power's awards spotlight DHT160 hybrids and 48%+ efficient methanol engines. These wins mark China's EV shift to unbeatable value and global compliance.

In November 2025, Voiture's Mengxiangjia (Dreamer) MPV dominated the premium segment with 9,027 units sold, securing its top spot while maintaining a 400,000 RMB average price—55% of buyers switching from BBA luxury brands. Meanwhile, Li Auto became the first automaker globally to earn the NG-eCall 2024 certification for its smart cockpit, paving the way for EU market entry by 2026. These milestones, alongside Haosi Power's innovation awards, underscore China's EV industry's shift from price wars to tech-driven value leadership.

Voiture Mengxiangjia: Redefining Premium MPVs with Tech Supremacy

Voiture's Mengxiangjia isn't just winning sales—it's reshaping luxury MPV standards. Cumulative sales have surpassed 150,000 units, with every third premium MPV sold in China being a Mengxiangjia. Unlike rivals stuck in 'price-for-volume' traps or gimmicky 'config stacking' (fridges, TVs, sofas), it thrives on genuine safety and tech.

Key highlights from the 2026 model:

- Global-first 800V hybrid architecture with 350km pure EV range and 62.5kWh battery.

- Huawei Qiankun ADS 4 autonomous driving and HarmonyOS 5 cockpit.

- Rear-wheel steering, million-yuan-class magic carpet air suspension, and CDC damping.

- 2000MPa cage body—first NEV MPV with C-NCAP 5-star rating.

This native EV platform solves space, safety, and range pain points in a 5.3m body, delivering sedan-like handling. Top-spec Qiankun Ultra version claims over 50% of sales, proving high-net-worth users prioritize 'real value' over brand halo.

| Feature | Mengxiangjia 2026 | Typical Joint-Venture MPV |

|---|---|---|

| Platform | Native EV 800V | Oil-to-EV retrofit |

| Pure EV Range | 350km | <200km (anxiety-prone) |

| Safety | C-NCAP 5-star cage | Lagging standards |

| Intelligence | Huawei ADS 4 + HarmonyOS 5 | Basic/missing |

| Avg. Price | ~400k RMB | Dropping for volume |

Voiture's November deliveries hit 20,005 units (+82% YTD), fueled by its MPV-SUV-sedan trio.

Li Auto's NG-eCall Triumph: Safety Tech Unlocks Global Doors

On December 9, 2025, Li Auto and Quectel nabbed the world's first NG-eCall 2024 certificate from Luxembourg, based on CEN 17240:2024 standards. This 4G/5G-based next-gen eCall enables faster responses, precise positioning, and multi-data transmission—mandatory for EU new cars from 2026, replacing old CS eCall by 2027.

Li Auto's smart cockpit integrates Quectel's car-grade 5G modules and QuecOpen for seamless voice/video crash alerts. VP Gou Xiaofei emphasized user safety as the core driver, blending hardware-software self-R&D with partner tech for rapid accident response.

This positions Li Auto ahead in exports, leveraging 5G's low latency for 'smart multi-response' rescues.

Haosi Power's Innovation Awards: Powertrain Frontiers

Haosi Power's first 'Aurora Bay Tech Innovation Awards' honored 20 projects, spotlighting hybrid and alt-fuel breakthroughs:

- DHT160: #1 prize—'11-in-1' SiC-integrated hybrid transmission on Geely's Galaxy models; also won Ningbo Tech Progress Award.

- BHE15TDEB (Horse B15): 1.5L hybrid engine ('China Heart 2025 Top 10'); powers Galaxy M9/L7/L6, scaling to 1M units/year.

- Methanol Engine: 48.76% efficiency via ultra-lean burn; -40°C cold-start patent enables harsh-climate sales.

These fuel Haosi's diversification into GaN tech, range extenders, and super-hybrids, boosting clients like Geely.

Why This Matters: China's EV Value Revolution

These stories signal China's EV ascent: Mengxiangjia proves native platforms command 400k RMB premiums, eroding BBA loyalty; Li Auto's cert fast-tracks EU compliance amid tariffs; Haosi's awards fortify supply chains. Stats: Voiture's 10-month growth streak, 55% luxury switchers, and Haosi's 30k+ monthly engine output highlight a pivot to 'tech moats' over configs.

Globally, it challenges Tesla/BYD in hybrids, validates China as safety/intel leader—expect export booms and stricter standards worldwide.

Looking Ahead: Tech Leadership Accelerates

2026 brings Mengxiangjia's full rollout, Li Auto's EU push, and Haosi's methanol/range-extender volumes. China's EVs are crafting a new luxury paradigm: original tech solving real pains. Watch for rivals imitating—but Voiture/Li/Haosi's systemic edges will sustain dominance.

Original Sources

Related Articles

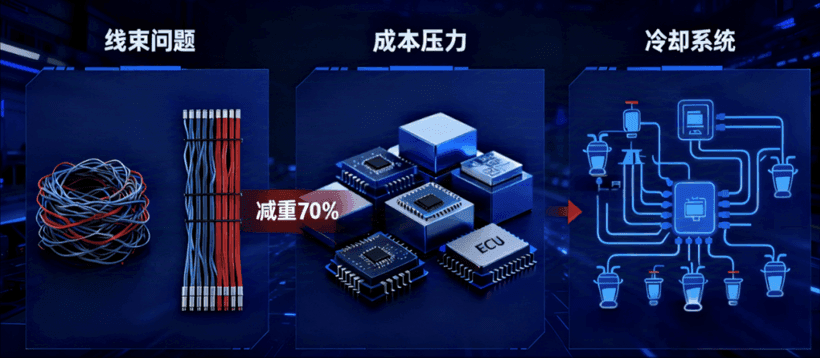

China EV News: XCU Hits 500K, L3 Approval, Power Deals

China's EV sector surges with Jingwei Hengrun's XCU hitting 500K units on Geely Xingyuan, MIIT approving two L3 autonomous models from Changan and BAIC BluePark, and Dongan Power's strategic lab with BAIC Manufacturing for off-road NEVs. These breakthroughs tackle wiring costs, boost autonomy, and enhance powertrains amid 2024's 9.5M NEV output. They solidify China's lead in software-defined vehicles and global EV competition.

Chinese EVs Dominate: Record Sales, AI Advances & Factory Milestones

Global EV sales smashed records at 2 million units in November 2025, with China's 1.32 million dominating amid BYD export highs and Tesla Shanghai's 400 millionth car. Funding surges for Deepal (6.12B RMB) and JAC (3.5B RMB) fuel smart platforms, while AI advances like DeepMind's 2028 AGI odds and具身智能 breakthroughs promise L4 'space robots.' EU price talks ease tariff fears, positioning Chinese EVs for global leadership.